Summary

Key questions

- What has been the trend of Photovoltaics (PV) and Solar Water Heaters (SWH) in the residential sector over the 2010-2016 period?

- What are the existing incentives aimed at promoting PV and SWH in residential sector?

- What are the specific barriers and limitations towards further share growth? Are the two technologies competing with one another?

Lead authors: The Energy and Water Agency (Malta)

Reviewers: Theodoros Zachariadis, Cyprus University of Technology

Introduction & Scope of the Brief

Policies favouring renewable energy are key for policy makers to achieve certain environmental targets. They not only provide a means to increase the share of renewable energy, but also a significant means to address climate change. Over the last few years such policies have taken many forms in different countries, regions and territories taking advantage of the most abundant natural renewable resource available to them, based on their geographical location and particular climatic features e.g. solar, wind, tidal, hydro, etc.

Considering the abundant hours of sunshine available, it is expected that among Mediterranean countries, solar should play a key part in achieving the ambitious renewable energy targets. In some cases, this has clearly been the case, in others this has not materialised, or has happened only partially.

Within this context, the aim of this policy brief is to present trends and results obtained by a number of European countries bordering the Mediterranean Sea namely, Croatia, Cyprus, France, Greece, Italy, Malta, Portugal, Slovenia and Spain in terms of exploiting solar photovoltaic and solar thermal technologies over the 2010-2016 period, specifically in the residential sector. The brief also looks at what type of incentives are behind the exploitation of photovoltaic (PV) and solar water heating (SWH) technologies in this sector; what incentives were discontinued and the reasons why they were discontinued; and, what are the main barriers and limitations hindering further growth of these two technologies in the residential sector.

Data presented in this brief was mostly made available by the respective National Energy Agencies.

Photovoltaic & Solar Water Heating Share

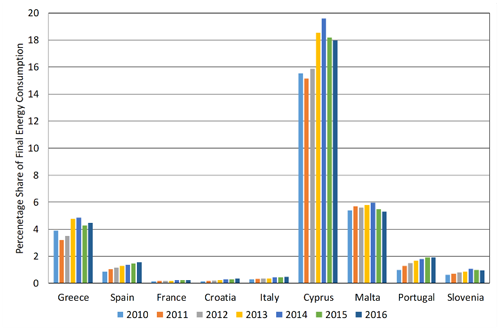

In terms of solar water heating, results have been diverse. Figure 1 below shows the share of residential final energy consumption supplied by solar thermal systems. In the absence of more detailed data, it is being assumed that for the large part, this solar thermal energy is being provided by add-on type installations installed in residential properties for the purpose of producing domestic hot water.

Figure 1: Share of residential final energy consumption covered by solar thermal over 2010-2016 period

Source: Eurostat

Cyprus is the leading country in this particular sector, with an average of 17% of the total final energy consumed by the residential sector (over the 7-year period analysed) covered by solar thermal. This is not surprising considering that 90% of households in Cyprus have a solar water heater installed, and that specific incentives and regulations, as will be discussed later, have made Cyprus a front runner in the exploitation of the solar thermal resource.

Malta and Greece also have a reasonable share of the total final energy consumed by the residential sector covered by solar thermal, around 4-6%. In the case of Malta, this means that around 20,000 households (≈13%) have a solar water heater. Over the same 7-year period the other countries analysed have averaged only 0.7% between them.

An interesting aspect emerging from the trends, is that in countries where solar thermal already has a significant share of the final residential energy consumption (Cyprus, Malta and Greece), the trend over the last few years has veered towards a downward tendency, probably indicating periods where incentives were not present or were less favourable, competition from other technologies or wider scoped policy decisions. Additionally, in the case of Cyprus, a reason for this downward trend may be sought in the fact that solar water heaters have almost reached saturation, whereas energy use continues increasing because of increased use of air conditioning and electric appliances.

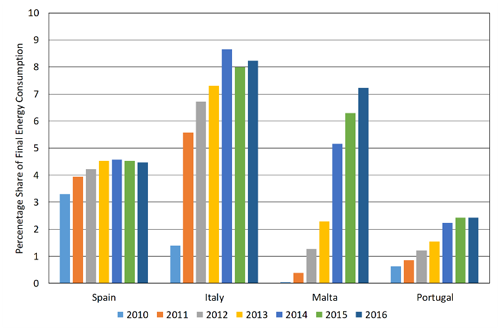

At the time of finalising this brief not all the data in relation to the use of photovoltaics in the residential sector was available. For this reason, trends can only be inferred for certain countries. Figure 2 shows the share of residential final energy consumption supplied by the installed photovoltaic systems in the residential sector1.

Figure 2: Share of residential final energy consumption covered by solar photovoltaics over 2010-2016 period

Source: National Energy Agencies

In terms of solar photovoltaic all countries for which data was available show that, over the 7-year period analysed, there has been a continuous positive and increasing trend in relation to the penetration of photovoltaic systems in the residential sector. Specifically, over the period investigated the huge annual jumps in terms of final energy consumption covered by photovoltaics in the residential sector, done by Italy and Malta, are noticeable.

In relation to Cyprus it has to be pointed out that in 2017 the total amount of installed photovoltaic capacity was of 38 MWp producing around 218.8 TJ of energy (equivalent to 1.6% of the residential final energy consumption). For Croatia the share of solar photovoltaics installed in the residential sector is very low, with the share of total solar energy consumption in final energy consumption being less than 0.5%.

Incentives for Solar Technologies

It is generally agreed that renewable sources of energy technologies often require some form of fiscal or regulatory incentive in order to be competitive with conventional fossil fuel based sources of energy.

In relation to photovoltaics typically fiscal incentives are aimed either at paying part of the capital cost upfront through some sort of grant or else investment repayment via the use of feed-in tariffs.

For solar thermal the capital grant, part-financing the initial cost, is typically the only incentive route. Having said that, regulatory aspects positively discriminating in favour of such technologies, for example, the mandatory installation of solar water heating technologies in new dwellings, also exist in some countries.

Table 1 shows the main incentives that six out of the nine Mediterranean countries investigated are currently employing as part of their strategy to increase the share of solar photovoltaic and solar thermal in the residential sector.

Table 1: Fiscal & Regulatory Incentives Measures

| Croatia | • A feed-in tariff is in place. For systems up to 10 kW the tariff is about €0.15/kWh. |

| Cyprus | • For SWH a financial support scheme covering the installation or replacement of solar water heaters in households has been in place for the last 10 years. The scheme provides a grant of €350 for the installation of a solar water heater system or a grant of €175 for the installation or replacement of the panels only. • New dwellings built after 2008 are legally required to have a SWH for hot water production. • For PV systems there is a grant of €900 per installed kW (up to a maximum of €2,700) for the installation of PV systems with power up to 5kW in households of vulnerable (mainly low-income) consumers. • All residential PV installations are subject to a net-metering agreement. • Since 2017 all new single-family residential buildings are required to have 25% of their energy requirement satisfied by RES (usually PV and/or SWH). For apartment buildings this percentage lies at 3%. |

| Italy | • A number of feed-in tariff schemes for new photovoltaic installations were launched over the last few years. • Solar thermal systems are included in a package of energy-efficiency measures which benefit from tax rebates. |

| Malta | • A scheme part-financing the purchase of residential SWH systems was launched in 2011 and periodically renewed. Currently, the beneficiary can benefit from 50% of eligible equipment and installation costs up to a maximum of €700. • A similar scheme for PV installations with a grant and a feed-in-tariff was launched for the first time in 2010. Over the years the conditions associate with incentivising the technology varied significantly. Initially, in 2010, the fiscal incentive included a grant covering 50% of eligible equipment and installation costs and a feed-in-tariff of €0.25/kWh of exported electricity guaranteed for eight years, after which any exported electricity is paid at the electrical supplier marginal cost. Current grant still covers 50% of eligible equipment and installation costs. However current feed-in-tariff is of €0.165/kWh of exported electricity guaranteed for six years, or alternatively, a household can opt to go for a 20-year long duration contract with a guaranteed feed-in-tariff of €0.155/kWh, but without a grant. • In October 2016, a Communal Solar Farm Scheme was launched whereby owners of dwellings with no opportunity to utilise their roofs for the installation of photovoltaics can enrol as participants. |

| Portugal | • Currently there are no fiscal or regulatory incentives. |

| Spain | • There are a number schemes aimed at promoting solar RES in the residential sector. Amongst these is IBI, a property tax whereby local authorities are empowered to apply a tax credit of up to 50% for the properties which have installed solar PV and/or thermal systems. |

Source: National Energy Agencies

Discontinued Incentives

Often fiscal incentives are modified or discontinued either because they have been unsuccessful in positively influencing the market, or because the incentive was time barred. In a number of cases incentives are discontinued as the technology being incentivised becomes competitive on its own merits and therefore not any more in need of incentives.

At least 3 countries, namely Malta, Cyprus and Italy reported how incentives for photovoltaics were reduced because the technology prices locally became so competitive compared to conventionally sourced electricity, that the technology was no longer in need of the significant incentives which were being given initially.

In the specific case of Cyprus, feed-in tariffs were removed completely in favour of a net-metering agreement. In the case of Malta, the feed-in tariff was lowered from an initial €0.25/kWh for the first scheme launched in 2010, to the current €0.165/kWh.

Barriers & Limitations Towards Further Growth

A number of barriers and limitations specific to the penetration of solar photovoltaic and solar thermal are often put to blame as to the reason why there is not a higher penetration of these technologies within the residential built environment. Typically, the barriers and limitations are associated with either of two broad categories: the limited space available, or the investment related uncertainties such as high initial installation costs or weak credibility of the industry.

In the residential sector where space is limited a number of countries identified available roof space or site constraints as being an issue, especially in the case of urban conservation areas or ‘heritage-sensitive areas’ where systems should be hidden from view in order not to distract too much from the architectural value of the building. Additionally, apartment buildings were identified as being the most problematic building typologies, either because there is no sufficient roof space for the installation of enough photovoltaic panels to cover the needs of all apartments’ tenants, or else because of ownership issues that often preclude the installation of solar PV. Even if an agreement can be reached in principle, it can still be quite complex to split the investment and accrued revenue from the sale of electricity. Other facilities, such as heating, ventilation and air conditioning systems, water storage and other amenities which compete for the same roof space, also pose a barrier to the installation of more solar technologies.

As regards the second category of barriers and limitations, some countries identified the following as the most relevant barriers: high initial investment when no incentives are made available, weak credibility of the industry, especially where no mandatory certification of installers exists as yet, lack of information among consumers and investors, and policy discontinuity.

In terms of competition between the two technologies, in general this is not considered to be an issue as the two serve different energy commodities. However, problems may arise if roof space is limited, in which case typically solar photovoltaic is preferred, due to its versatility as an energy source. This preference may be further supported if the investment in PV is perceived as providing a better return.

Conclusions

Solar energy in its two main forms namely solar thermal and solar photovoltaics, is considered as a very good alternative to conventional fossil fuels, especially in regions and countries such as those bordering the Mediterranean, which have a high solar potential.

As has been discussed in this brief, within the residential sector, results on the exploitation of this resource have been diverse, with varying levels of success. Cyprus is the front runner in terms of solar thermal exploitation in the residential sector, whilst based on the data obtained for the countries investigated, both Malta and Italy have achieved considerable penetration of photovoltaics within the residential sector.

It is clear that these results are largely due to the level of incentives utilised by the various countries. Where the incentives were significant, or regulations dictated that a certain technology had to be utilised, then results showed a high share of residential final energy consumption covered by solar.

Notwithstanding this fact, this brief also highlighted a number of limitations and barriers which are preventing a wider exploitation of solar energy within the residential sector.

Amongst these barriers are (i) high initial investment costs when no incentives are made available, (ii) weak standing of the industry where no mandatory certification of installers exists as yet, (iii) lack of information among consumers and investors, and (iv) policy discontinuity.

References

Croatia:

Italy:

Malta:

- Regulator for Energy and Water Services - PV Scheme Applications

- Regulator for Energy and Water Services - SWH Scheme Applications

Spain:

- Royal Decree 900/2015: Regulates administrative and technical conditions for electricity self- consumption and defines a framework on which PV installations can supply electricity for self-consumption.

- Order FOM/1635/2013-Technical Building Code: Define a Solar minimum contribution to Domestic Hot water and PV minimum contribution for electricity.

- Royal Decree 238/2013-RITE: Regulates administrative and technical conditions of thermal installations in buildings.

Notes

- 1: Where the available data was provided in MWp of installed capacity, it was assumed that the average annual energy yield per kWp is of 1,600 kWh/annum.